Understanding Funding Types and the Capital Stack

Overview

Understanding Funding Types and the Capital Stack

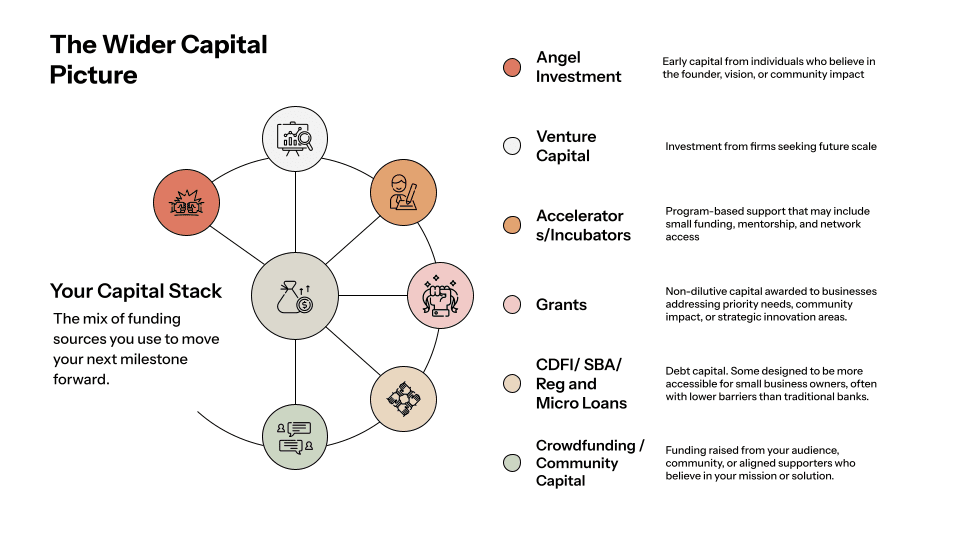

Most founders assume they need to choose between venture capital or bootstrapping. The reality is more nuanced. Successful companies layer multiple funding sources strategically—combining equity, grants, debt, and revenue to fuel different stages of growth.

This blend is called the capital stack. Building one intentionally gives you more control, extends your runway, and attracts investors who align with your mission.

What you'll learn:

The two main categories of funding and how they differ

What each funding type offers (and what it costs)

How to layer sources strategically as you scale

Why your capital stack matters to future investors

Two Categories of Funding

All funding falls into one of two categories based on what you exchange for capital:

Dilutive Funding: Trading Equity for Capital

Dilutive funding means investors give you cash in exchange for ownership in your company. You gain capital and strategic partners. You give up a percentage of future upside.

Venture Capital (VC)

Institutional capital designed for startups with high growth potential and clear paths to significant returns. VCs typically invest $500K+ and expect 10x+ returns within 7-10 years.

Angel Investment

High-net-worth individuals invest personal funds, usually at earlier stages than VCs. Check sizes range from $10K to $250K. Angels often bring industry expertise and networks alongside capital.

Accelerators

Time-bound programs (typically 3-6 months) that provide small equity investments ($25K-$150K), mentorship, and demo day visibility in exchange for 5-10% equity.

Non-Dilutive Funding: Capital Without Giving Up Ownership

Non-dilutive funding lets you raise capital while maintaining full ownership. Some sources require repayment. Others come with mission alignment or deliverable expectations.

Grants

Mission-aligned capital from government agencies, philanthropic foundations, or corporations. Grants typically range from $10K to $5M+ and don't require repayment or equity. They often fund specific projects, pilot programs, or community impact initiatives.

Crowdfunding

Capital raised from the public through platforms like Kickstarter, Indiegogo, or equity crowdfunding portals. Backers receive early products, perks, or (in equity crowdfunding) small ownership stakes.

Revenue-Based Financing (RBF)

Investors provide capital in exchange for a percentage of monthly revenue until a predetermined cap is reached (typically 1.5-3x the principal). No equity dilution, but repayment affects cash flow.

Debt / Loans

Traditional loans or lines of credit from banks or alternative lenders. Requires repayment with interest. Ownership remains intact, but debt service creates fixed obligations.

Trade-offs and Timing

Each funding type comes with different timelines, expectations, and implications for how you build your business. Founders who understand these trade-offs make better decisions about which sources to pursue and when.

The Capital Stack in Practice

Founders rarely rely on a single funding source. The most resilient businesses layer multiple types strategically across different growth stages.

Stage 1: Ideation + MVP

Small grants, pre-seed angel checks, or founder capital to validate the problem and build an initial prototype. Goal: Prove the concept works.

Stage 2: Early Traction

Accelerator capital, larger grants, and seed-stage VC to refine the product and acquire early customers. Goal: Demonstrate product-market fit.

Stage 3: Growth

Series A VC rounds layered with grants (for mission-driven initiatives), revenue-based financing (to extend runway between equity raises), or debt (to finance inventory or equipment). Goal: Scale efficiently without over-diluting.

Stage 4: Expansion

Later-stage VC, debt facilities, or public markets. Goal: Accelerate growth while optimizing your cap table, which, if you're unaware, is a chart used in early fundraising stages that shows who owns what percentage of the company. It lists all shareholders and their ownership stakes so founders and investors have a clear picture of how equity is divided.

What's Next

Now that you understand the full landscape of funding types and how they fit together strategically, the next lesson focuses specifically on grants: the types available, who qualifies, and the most common barriers founders face when accessing them.