The Current Funding Landscape

Overview

The funding environment has changed.

Fewer checks are being written at every stage. Venture firms are moving more slowly. Banks have tightened lending criteria. Alternative lenders that once served underestimated founders now face their own capital constraints.

This affects early-stage and growth-stage companies that expected more predictable access to funding. The timelines have stretched. The bar has risen. The wait between milestones and capital has lengthened.

Investors now prioritize traction over narrative. They look for customer retention, managed burn rates, and clear paths to sustainable operations. Founders without these signals face longer fundraising cycles and fewer viable options.

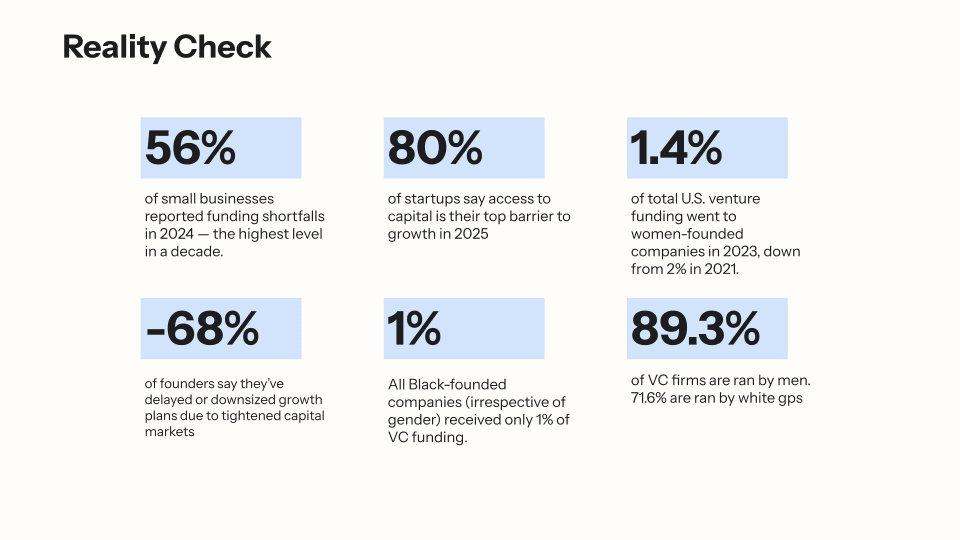

The data reflects this shift.

Small business surveys consistently report funding gaps. A significant share of startups cite capital access as their primary growth barrier. Many founders have paused hiring or delayed expansion because their runway has shortened.

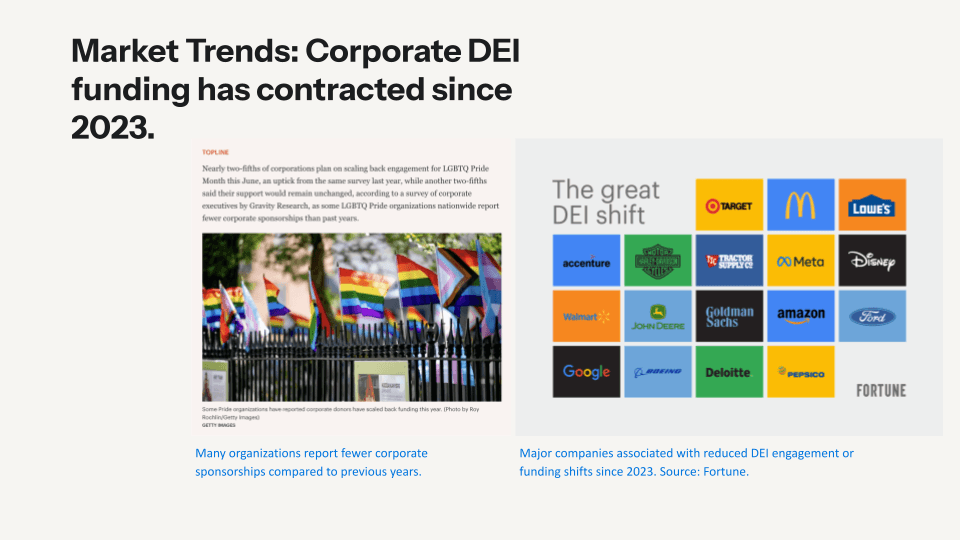

For communities that have historically received less institutional support, the gap widens further. Venture allocation to Black founders, women founders, and LGBTQ+ founders remains disproportionately low. These patterns persist across market cycles, which makes diversifying your capital sources essential rather than optional.

The environment is uncertain. Many founders face the same pressures. Diversifying your capital sources creates flexibility that helps you keep moving when conditions shift.

What's Next

The next lesson explores how this shift affects dilutive funding pathways: venture capital, angel investment, and accelerator programs. You'll see where the bottlenecks exist and how to navigate them strategically.